📌 TL;DR – Quick Summary

Finbro is a trusted online lending platform in the Philippines offering quick approval loans from ₱1,000 to ₱50,000. First-time borrowers get ₱5,000 at 0% interest.

Whether you’re employed, self-employed, or have no credit history, Finbro makes borrowing fast, mobile-friendly, and 100% digital — with flexible repayment terms and approval in under 24 hours.

📑 Table of Contents

- Finbro Loan Overview

- Is Finbro Legit and SEC-registered?

- Finbro Loan Summary & Key Details

- Interest Rates & Fees of Finbro Loan

- Key Features of Finbro Loan

- Who Should Apply for a Finbro Loan?

- Finbro Loan Pros and Cons

- Eligibility & Requirements for Finbro Loans

- Step-by-Step Guide: How to Apply for a Finbro Loan

- Easy Ways to Repay Your Finbro Loan

- Finbro Loan vs Other Loan Providers in the Philippines

- Frequently Asked Questions(FAQs)

- Final Thoughts: Is Finbro Loan Worth It?

Finbro Loan Overview

Finbro is an online lending platform operated by Sofi Lending, Inc., providing short-term loans in PH tailored specifically for Filipinos. Known for offering fast cash loans online, Finbro ensures obtaining funds is simple, quick, and accessible—ideal for emergencies, bill payments, or other urgent financial needs.

Recognized as one of the most accessible and fast-approval loan apps in the Philippines, Finbro extends digital financial solutions to borrowers nationwide. Whether you reside in Metro Manila, Luzon, Visayas, or Mindanao, Finbro’s entirely online platform enables quick loan applications right from your smartphone or computer.

Finbro loans range from ₱1,000 to ₱50,000, with flexible repayment terms of up to 12 months. Additionally, new borrowers enjoy a special promotion: a first loan of ₱5,000 with 0% interest.

Is Finbro Legit and SEC-registered?

Yes, Finbro is a legitimate and SEC-registered lending platform operating legally in the Philippines. It is regulated by the Securities and Exchange Commission (SEC), ensuring transparency, reliability, and security in all loan transactions.

- SEC Registration No.: CS201908275

- Certificate of Authority No.: 2990

You can verify Finbro’s registration directly on the official SEC Philippines website by searching with their SEC Registration No.

To enhance convenience and accessibility, Finbro collaborates with reputable financial institutions and payment providers such as Cebuana Lhuillier, M Lhuillier, TrueMoney, and UnionBank, allowing borrowers nationwide to easily manage their loans through trusted and widely accessible channels.

Finbro Loan Summary & Key Details

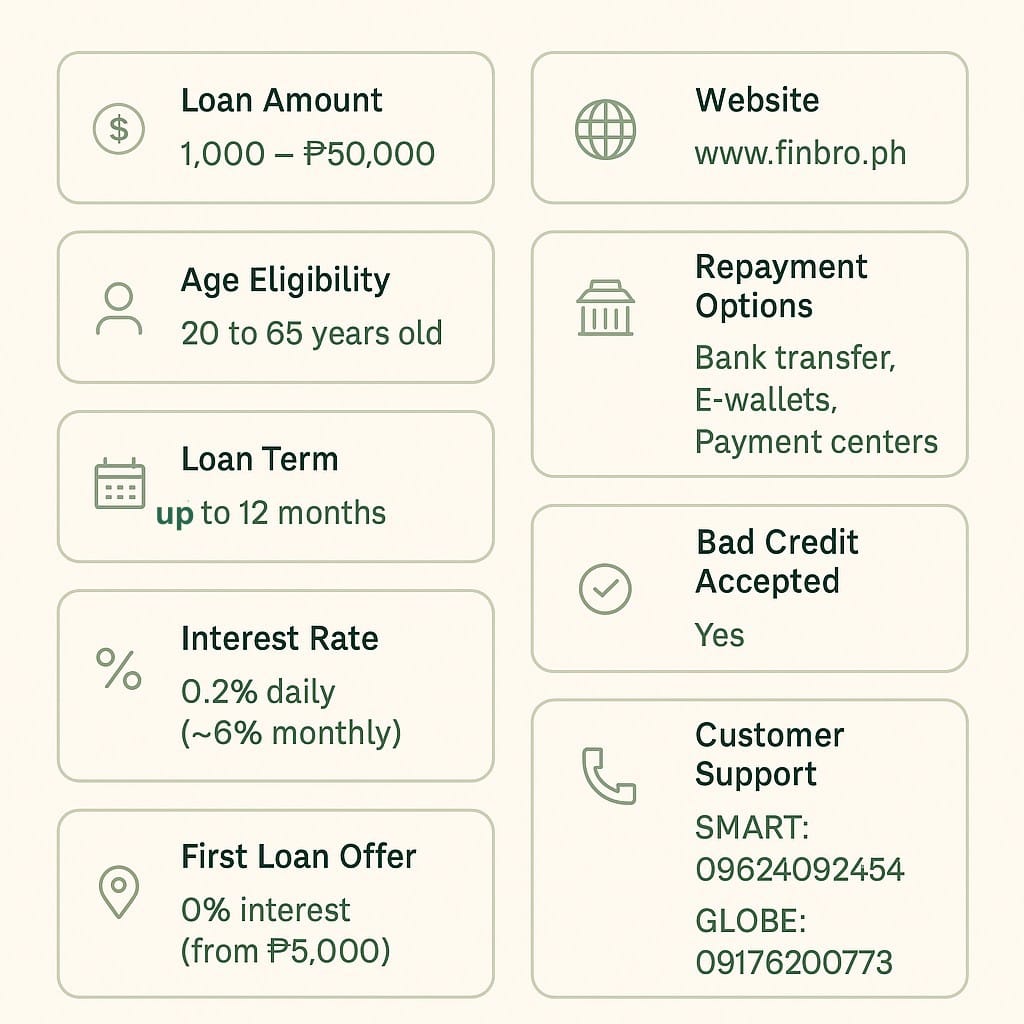

Before applying for a Finbro loan, review the summary below to quickly understand key features and requirements:

| Feature | Details |

|---|---|

| Website | www.finbro.ph |

| Loan Amount | ₱1,000 – ₱50,000 |

| Age Eligibility | 20 to 65 years old |

| Loan Term | up to 12 months |

| Interest Rate | 0.2% daily (~6% monthly) |

| First Loan Offer | ₱5,000 with 0% interest |

| Requirements | Filipino resident, stable income |

| Repayment Options | Bank transfer, E-wallets, Payment centers (e.g., Cebuana, M Lhuillier, TrueMoney) |

| Bad Credit Accepted | ✅ Yes |

| Customer Support |

SMART: 09624092454 GLOBE: 09176200773 |

Interest Rates & Fees of Finbro Loan

Finbro provides clear, transparent, and competitive interest rates for their short-term loan PH products. With interest rates starting from 0.2% daily (~6% monthly), Finbro is an attractive option for anyone looking for fast cash loans online.

For first-time users, Finbro provides a special introductory offer: a 0% interest rate on initial loans starting at ₱5,000. This is an excellent opportunity to test Finbro’s services without upfront financial risk.

Additionally, Finbro guarantees no hidden fees, displaying the full cost of your loan clearly during the application process. Note that your interest rate might slightly vary depending on your personal credit profile.

Looking for even lower interest rates? Check out our guide on Low-interest Loans in the Philippines for more options.

📊 Loan Options Overview

| Interest Rate | Loan Term | Loan Amount |

|---|---|---|

| 6% monthly or 0.2% daily (Max APR 180%) | 62 days – 12 months | ₱1,000 – ₱50,000 |

💡 Example Loan Cost

For a ₱1,000 loan borrowed over 12 months:

- Monthly Payment: ₱95.83

- Total Repayment: ₱1,150

- APR: 180%

💡Want larger loan amounts or longer terms? Apply with Finbro and borrow up to ₱50,000 fast!

Key Features of Finbro Loan

Finbro simplifies the borrowing experience by providing online loan approval within 24 hours in the Philippines, making it perfect for borrowers who need fast cash loans online without lengthy paperwork or waiting times.

👤Who Should Apply for a Finbro Loan?

Finbro is particularly suitable for salaried employees, freelancers, and self-employed individuals seeking short-term loan PH options. With online loan approval within 24 hours in the Philippines, Finbro is also ideal for individuals needing rapid financial assistance.

Finbro is ideal for:

- Salaried employees needing urgent cash

- Freelancers and self-employed Filipinos with stable income

- Individuals with no credit history or low credit scores

- Borrowers looking for 0% interest loans or fast approval

❌ Not suitable for:

- People under 20 years old

- Those without valid government IDs or digital access

- Borrowers needing large long-term loans over ₱50,000

Finbro Loan Pros and Cons

Before deciding if a Finbro loan suits your financial needs, consider these key advantages and disadvantages:

| ✔️ Pros | ❌ Cons |

|---|---|

| ✅ Lower and fixed interest rates | ❗ High penalties for late payments |

| ✅ Flexible repayment options (no prepayment penalty) | ❗ No physical branches (fully online) |

| ✅ Quick application process, providing online loan approval 24 hours Philippines. | ❗ Strict eligibility verification |

| ✅ Accepts borrowers with bad credit | ❗ Higher interest rates for high-risk borrowers |

| ✅ User-friendly website and mobile access | ❗ Risk of over-borrowing due to easy access |

| ✅ Transparent fees and terms | ❗ Fully reliant on digital communication |

| ✅ Excellent choice for borrowers seeking fast cash loans online with minimal paperwork. |

Eligibility & Requirements for Finbro Loans

Before applying for a Finbro loan, ensure you meet the following basic eligibility criteria:

- ✅ Nationality & Age: Filipino citizen, aged between 20 to 70 years old.

- ✅ Stable Income: Provide proof of consistent and stable income (e.g., payslips, employment certificate).

- ✅ Valid ID: Submit at least one valid government-issued ID:

- SSS ID

- UMID

- Passport

- Driver’s License

- ✅ Bank Account: Have an active bank account for loan disbursement and repayments.

- ✅ Identity Verification: Submit a clear selfie for identity confirmation and verification purposes.

Meeting these requirements ensures a quick and hassle-free loan approval process with Finbro.

Step-by-Step Guide: How to Apply for a Finbro Loan

Applying for a Finbro loan is easy and fully online. Follow these simple steps to complete your application quickly:

- Visit the Website Go to Finbro.ph and click “Apply Now.”

- Complete the Application Form

Provide accurate personal, employment, and financial information. - Upload Required Documents

Submit necessary documents, including:- Valid government-issued ID

- Proof of stable income

- A clear selfie for identity verification

- Wait for Approval

After submitting your application, wait for approval. Finbro will notify you promptly via SMS or email.

Once approved, funds are quickly disbursed directly to your bank account or preferred payout method.

Tips for Successful Finbro Loan Approval

Increase your chances of approval and get the best possible loan terms with these quick tips:

- Double-Check Your Information:

Ensure all details provided in your application are accurate and up-to-date to avoid unnecessary delays or rejection. - Apply at the Right Time:

Consider applying when your credit score is at its best. A higher credit rating often leads to more favorable interest rates and loan terms.

Following these simple steps will help streamline your loan application and enhance your chances of securing a Finbro loan quickly and efficiently.

Easy Ways to Repay Your Finbro Loan

Repaying your Finbro loan is simple and convenient. Follow these tips to ensure timely payments and avoid unnecessary charges:

- Choose a Payment Method:

Easily repay through bank transfers, popular e-wallets, or trusted payment centers (Cebuana Lhuillier, M Lhuillier, TrueMoney). - Set Payment Reminders:

Use phone alerts or calendar reminders to avoid missing your due dates. - Pay Above the Minimum:

When possible, pay more than the minimum required amount to reduce interest and pay off your loan faster. - Keep All Payment Receipts:

Save your payment confirmations and receipts as proof of payment in case of any discrepancies. - Contact Support for Issues:

If you encounter any issues during repayment, promptly reach out to Finbro’s customer support:- SMART: 09624092454

- GLOBE: 09176200773

- Monitor Your Loan Online:

Regularly check your loan account on Finbro.ph to stay updated on your loan balance and payment history.

By following these simple steps, you’ll successfully manage your Finbro loan repayments without stress.

📊 Finbro Loan vs Other Loan Providers in the Philippines

See how Finbro stands out from traditional banks and other online lenders in the Philippines:

| 📌 Feature | 🏦 Finbro | 🏛️ Traditional Banks | 💡 Other Online Lenders |

|---|---|---|---|

| 📈 Interest Rate | ~6% monthly (0% first loan) | Higher (12%+ annually) | Varies widely (8%–15% monthly) |

| ⏱️ Approval Time | Within 24 hours | 3–7 days | 1–2 days |

| 💻 Application Method | Fully online | Offline or hybrid | Online |

| 🔁 Repayment Flexibility | High | Low–Medium | Medium |

| 🔎 Credit Score Requirement | Flexible / Accepts bad credit | Strict | Moderate |

| 📱 Technology & App | Excellent, mobile app available | Basic | Good |

Want more detailed comparisons? See our in-depth article on Best Online Loans in the Philippines (2025) to make a well-informed decision.

Frequently Asked Questions (FAQs)

1. Is Finbro Loan Legit in the Philippines?

Yes, Finbro is a legitimate online lender registered with the SEC Philippines (Registration No.: CS201908275, Authority No.: 2990). You can verify this via the official SEC website.

2. How fast can I get approved for a Finbro Loan?

Finbro offers online loan approval within 24 hours. After approval, funds are quickly transferred to your bank account or e-wallet.

3. Can I get a loan from Finbro with bad credit?

Yes, Finbro accepts borrowers with poor or no credit history. However, interest rates may be slightly higher for high-risk borrowers.

4. What are Finbro’s loan interest rates?

Finbro’s standard interest rate is 0.2% daily (~6% monthly). First-time borrowers can enjoy a 0% interest rate for loans starting at ₱5,000.

5. What happens if I miss my Finbro loan payment?

Missing your loan payment can result in high penalty fees, negatively impact your credit score, and lead to challenges in future loan approvals. Always repay loans promptly or contact customer support immediately if you encounter issues.

6. How can I repay my Finbro loan?

You can repay your Finbro loan easily via bank transfer, e-wallets, or trusted payment centers (Cebuana Lhuillier, M Lhuillier, TrueMoney).

7. Does Finbro require collateral for loans?

No, Finbro offers unsecured short-term loans in PH—no collateral required.

8. Who is eligible for a Finbro loan?

Eligible borrowers are Filipino citizens aged 20–70, with stable income, a valid government-issued ID, an active bank account, and the ability to provide identity verification via selfie.

Final Thoughts: Is Finbro Loan Worth It?

Finbro provides a fast, secure, and legitimate personal loan option tailored specifically for Filipino borrowers. Although there are certain limitations—such as strict eligibility verification and potential penalties for late payments—its clear and transparent terms, flexible repayment options, and user-friendly online platform make Finbro an excellent choice for those seeking accessible financial solutions in the Philippines.

If you need quick funds with straightforward terms and convenient digital access, Finbro is certainly worth considering.

Need More Flexible Loan Options? ✅

Try Finbro – 0% for 1st loan, fast approval, flexible terms, and loans up to ₱50,000!

Apply with Finbro